21 May 5 tax myths about property rentals

This is the second in our series on tax issues relating to your investment property. We’ve already covered the importance of having a tax depreciation schedule and items you can and cannot claim. If you missed it: only pay the tax you need to. This time we’re going to take a look at some common misconceptions about the taxation of rental properties.

1. If you make a loss when you sell a rental property, you can reduce the tax you have to pay on your salary income.

False: Any loss on the sale of investments is generally a capital loss and can only be used to reduce capital gains. They cannot be offset against ordinary income.

2. If you have a property that you rent to a friend or relative and you only charge them a small amount of rent, you can still claim all of the costs for the property to offset this income.

False: Where a property is rented at less than market value to a related party, you can claim only a proportion of the expenses. That proportion is equal to the actual rent charged to the market value of the rent.

3. If you have a loan that is secured against an investment property then all of the interest on that loan is a tax deduction.

False: To determine the tax deductibility of interest on a loan, you need to ascertain the purpose for which the loan funds were borrowed. The ATO will trace loan funds drawn down to determine what the money is spent on. If the funds were not spent on the property or items relating to the property, then the interest on that portion of the loan will no be deductible.

4. If you have a holiday rental property it is okay to stay in the property at times during the year and it will not impact on the amount of expenses that can be claimed.

False: Where the owners of a property have private use of that property then the expenses must be apportioned based on the time used for private purposes to remove the portion of expenses relating to that private use. For example, if you were to stay in the property 1 month of the year then 1/12 of the expenses for that year will not be deductible.

5. Any money spent on the physical property will be claimable as a repair.

Partly true: Generally any money spent on repairs and maintenance that bring the property back to its original condition/function can be claimed as a repair. Any spent to improve the property beyond its original condition/function will be an improvement and must be written off over the life of that improvement.

There are also special rules that determine repairs as improvements where a property is purchased in a run-down condition and within a short period money is spent on repairs to that property to bring it into an acceptable condition.

(Ref: Hanrick Curran Accounts: “Tax Myths, Rumours and Mistruths for Investment Properties

Debunked” 20/09/2016)

One to keep an eye on is the announcement in the Federal Budget 2017 that claims for travel expenses for matters relating to investment properties will be abolished, and allowable depreciation for plant and equipment will be scaled back. There is no start date for these items as they must first pass the parliament.

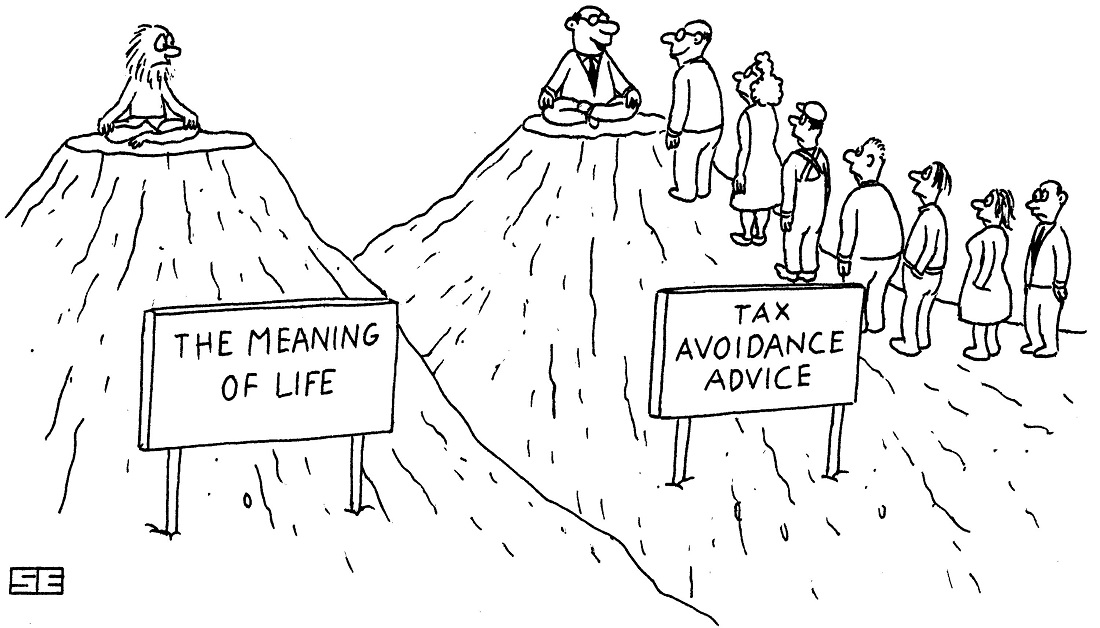

The lesson of course is to get good advice before investing in property and certainly at tax time.

Sorry, the comment form is closed at this time.